The U.S. labor market added significantly more jobs than expected in September, with the unemployment rate unexpectedly declining, presenting a stronger labor market than Wall Street had anticipated.

Data released Friday by the Bureau of Labor Statistics showed 254,000 jobs were added in September, well above the 150,000 predicted by economists.

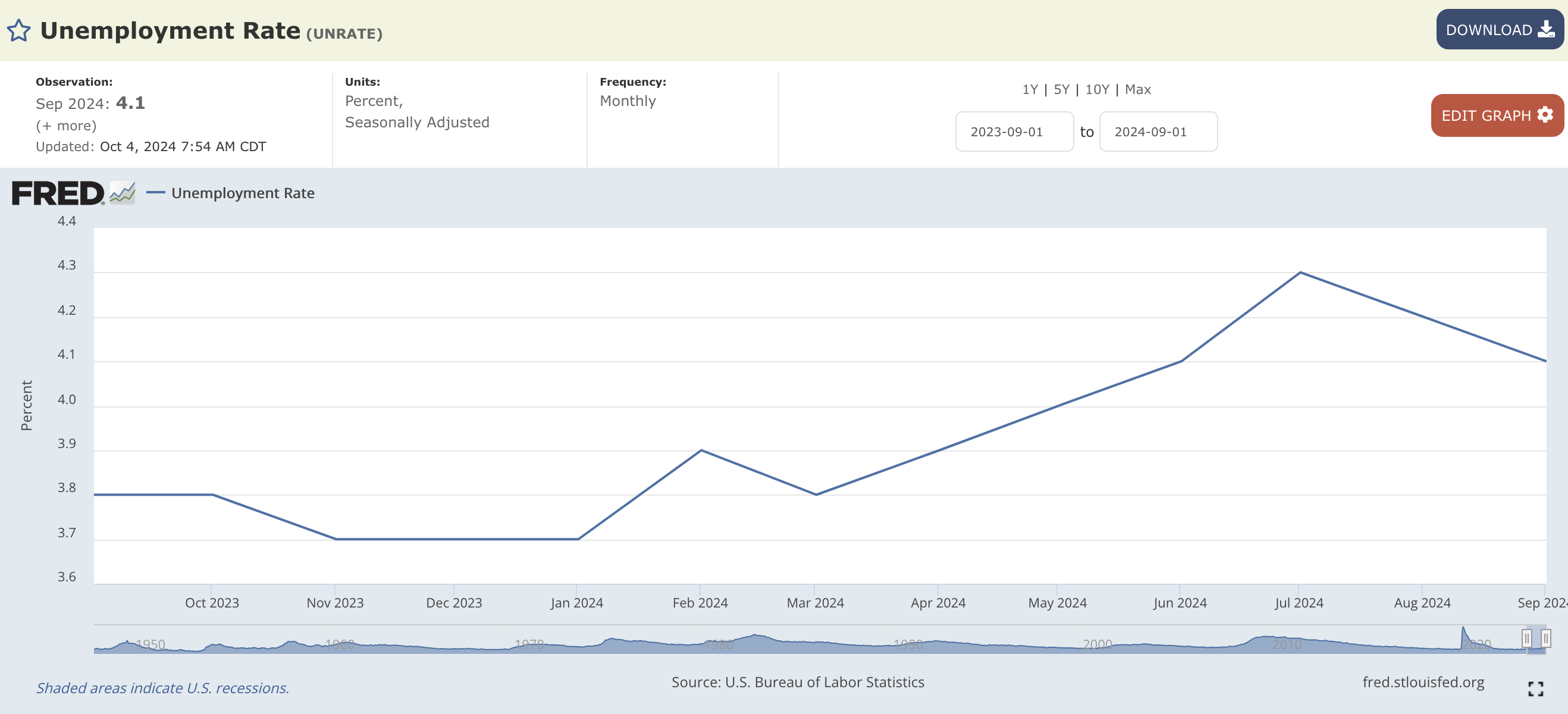

At the same time, the unemployment rate dropped to 4.1%, down from 4.2% in August. This marked a strong rebound from August’s revised job growth of 159,000. Additionally, revisions to both July and August data revealed that 72,000 more jobs were created in those months than previously reported.

Wage growth, a critical indicator of inflationary pressures, rose to 4% year-over-year, up from 3.9% in August. On a monthly basis, wages increased by 0.4%, matching the previous month’s gain.

Ahead of Friday’s release, there had been questions about whether the labor market was cooling enough to prompt another significant interest rate cut from the Federal Reserve. However, Robert Sockin, senior global economist at Citi, told Yahoo Finance that the stronger-than-expected report makes it less likely the Fed will act with the same urgency it showed at its September meeting, when rates were cut by half a percentage point.

“This pushes the Fed’s timeline further out,” Sockin noted, suggesting it’s uncertain whether the Fed will make another 50-basis-point cut this year.

Following the report, market expectations for a half-point rate cut in November fell sharply, with the CME FedWatch Tool showing just a 5% probability, down from 53% a week ago.

Reflecting on the job market’s strength, Capital Economics’ chief North America economist Paul Ashworth remarked in a client note, “Given the robust employment numbers in September, the real debate for the Fed should be whether to ease monetary policy at all. The possibility of a 50-basis-point cut is now off the table.”