A key report on US inflation released by the Bureau of Labor Statistics reveals that consumer price increases eased slightly in September, though core inflation remains stubborn. The latest data, unveiled Thursday, shows inflation moderating overall but still hovering above the Federal Reserve’s 2% target.

Headline Inflation Slows

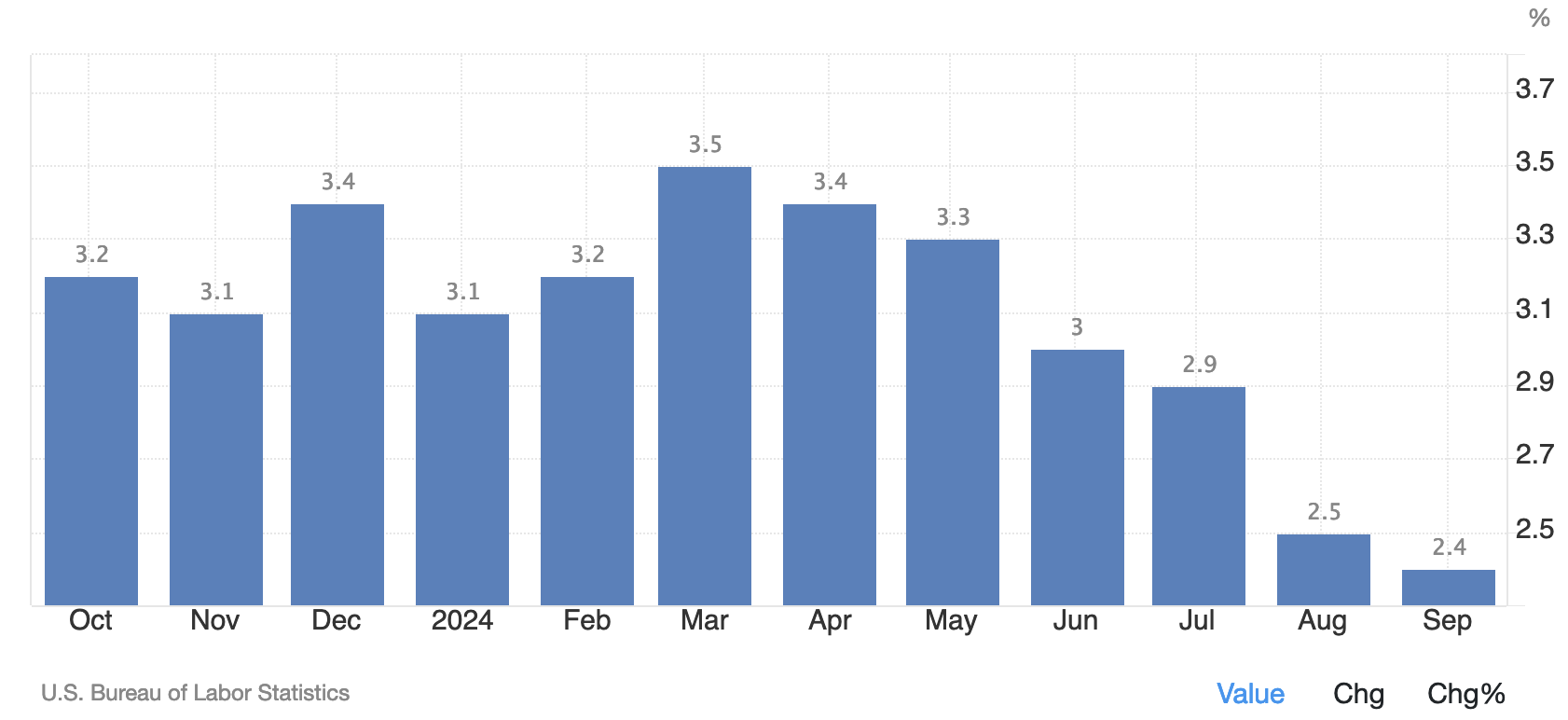

The Consumer Price Index (CPI) rose by 2.4% year-over-year in September, down slightly from the 2.5% increase recorded in August. However, the figure came in hotter than economist expectations of a 2.3% annual rise. On a month-over-month basis, prices rose 0.2%, in line with August’s pace and above forecasts for a 0.1% increase.

Core Inflation Still High

Core inflation, which excludes volatile food and energy prices, showed a 0.3% month-over-month increase, above expectations of 0.2%. On an annual basis, core prices climbed 3.3%, marking a slight rise from August’s 3.2%. This persistent core inflation reflects ongoing price pressures despite signs of broader inflation cooling.

Federal Reserve’s Response

While inflation is trending down, the Federal Reserve is also closely monitoring the labor market. Recent data indicates surprising resilience in hiring, which could influence the Fed’s approach to interest rate cuts. The US economy added 254,000 jobs in September, well above the 150,000 predicted by economists, with unemployment dipping to 4.1%.

Interest Rate Outlook

The strong labor market report is shifting expectations for the Fed’s next move. While some policymakers favored a larger 50 basis point cut in September, others leaned toward a smaller 25 basis point cut. Following Thursday’s inflation report, market watchers are now pricing in more than an 80% chance of a 25 basis point cut in November, according to the CME FedWatch Tool.

As the Fed grapples with the balance between cooling inflation and a strong labor market, its next decision on interest rates could shape the economic landscape heading into 2024.