Blockchain ETFs vs. Bitcoin ETFs: A Comprehensive Guide

As Bitcoin solidifies its role in the investment world, exchange-traded funds (ETFs) focused on Bitcoin and blockchain technology have surged in popularity. These ETFs offer investors exposure to the growing digital asset sector without the complexities of managing the assets directly.

Blockchain ETFs provide diversified exposure to companies leveraging blockchain technology across industries such as finance, healthcare, and supply chain management. On the other hand, Bitcoin ETFs give investors direct exposure to Bitcoin’s price fluctuations, either by holding the cryptocurrency or tracking its value via futures contracts.

While both ETF types share a connection to blockchain, they serve different purposes and carry distinct risk profiles. Understanding these differences is crucial for investors seeking to diversify their portfolios with digital asset-related investments.

What Are Blockchain ETFs?

Blockchain ETFs track companies that invest in or develop blockchain technology, offering a broad-based investment in the sector. They do not focus on a single cryptocurrency, making them less volatile than cryptocurrency-specific funds.

Blockchain is a transformative technology that powers Bitcoin but has applications far beyond cryptocurrencies. For example, companies like IBM use blockchain for supply chain optimization, while Visa explores blockchain to streamline payments.

Christian Magoon, CEO of Amplify ETFs, explained, “Bitcoin needs blockchain, but blockchain doesn’t need Bitcoin,” highlighting the independence of blockchain technology from any single application, including cryptocurrencies.

Popular companies featured in blockchain ETFs include Visa, Nvidia, and Honeywell, all using blockchain to enhance various aspects of their operations.

What Are Bitcoin ETFs?

Bitcoin ETFs focus specifically on Bitcoin, offering investors direct or indirect exposure to the world’s largest cryptocurrency by market capitalization. These ETFs typically track Bitcoin’s price through futures contracts or by holding Bitcoin directly.

The first Bitcoin futures ETF, the ProShares Bitcoin Strategy ETF (BITO), launched in October 2021, marking a significant milestone for cryptocurrency investors. Since then, several Bitcoin ETFs have emerged, including Valkyrie’s Bitcoin Strategy ETF (BTF) and VanEck’s Bitcoin Strategy ETF (XBTF), allowing investors to capitalize on Bitcoin’s price movements without owning it outright.

In 2024, the SEC approved the first spot Bitcoin ETFs, a landmark decision following years of regulatory hurdles. These ETFs hold Bitcoin directly, offering even closer price tracking compared to futures-based products.

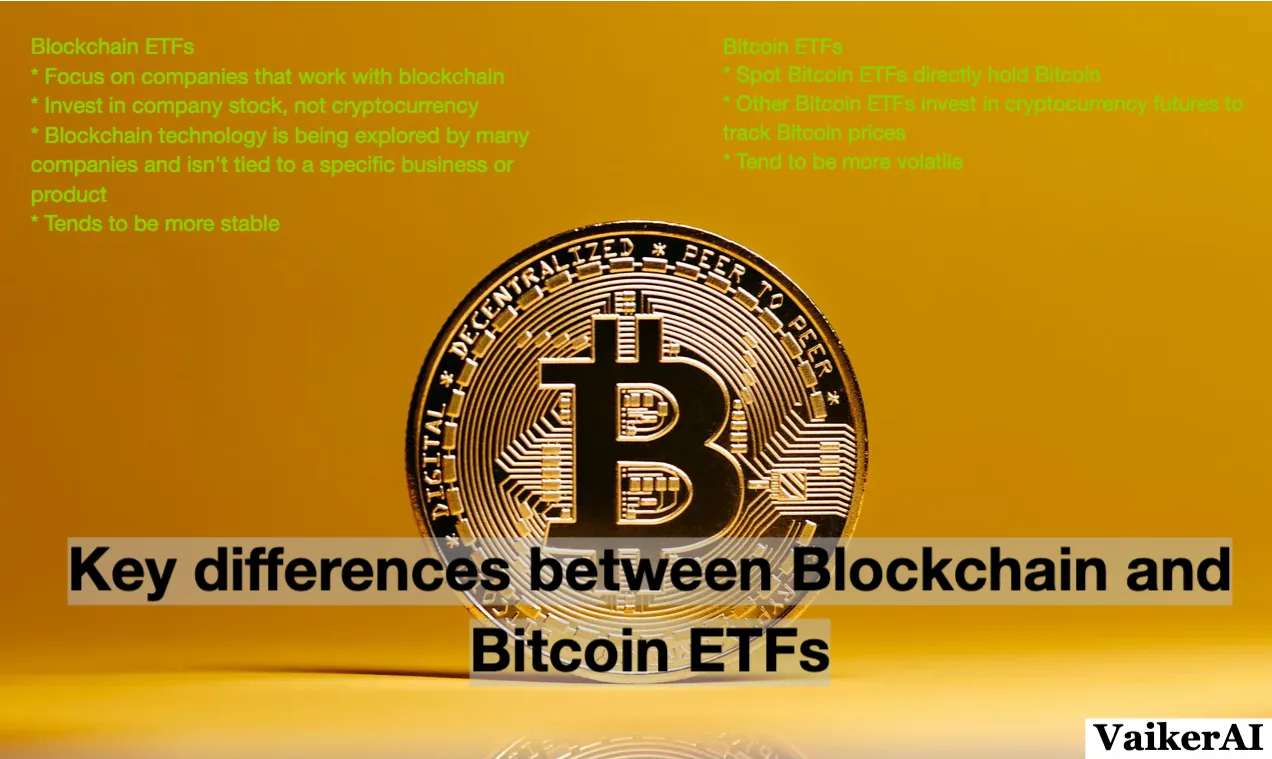

Key Differences Between Blockchain and Bitcoin ETFs

- Blockchain ETFs: Focus on companies that integrate blockchain technology. These ETFs invest in stocks, making them less volatile and more diversified across sectors. They provide exposure to the potential of blockchain without focusing on any particular cryptocurrency.

- Bitcoin ETFs: Specifically target Bitcoin’s price movements, either through futures contracts or direct ownership. Bitcoin ETFs are more volatile, closely tied to the cryptocurrency market’s ups and downs.

How Do You Invest in Blockchain ETFs?

You can invest in blockchain ETFs through most online brokerage platforms, including Fidelity, E*Trade, and Robinhood. Simply search for “blockchain” using the ETF screener provided by your broker to find a list of available blockchain-focused funds. From there, review each fund’s holdings and strategy to ensure it aligns with your investment goals.

How Do You Invest in Bitcoin ETFs?

To invest in Bitcoin ETFs, use the same brokerage platform you use for other ETFs. Search for terms like “Bitcoin” or “crypto” in the ETF screener to find cryptocurrency-related funds. Once you have a list of options, research each fund’s management style, fees, and strategy to decide which one best fits your investment approach.

When Did Bitcoin ETFs Start Trading?

Bitcoin futures ETFs began trading in October 2021, providing investors with exposure to Bitcoin through futures contracts. The first spot Bitcoin ETFs, which directly hold Bitcoin, were approved in January 2024.

How Do Bitcoin and Blockchain ETFs React to Changes in Technology and Finance?

Bitcoin ETFs tend to be more sensitive to events within the cryptocurrency market, such as regulatory changes, institutional adoption, or major economic developments. Blockchain ETFs, by contrast, are influenced by the broader adoption of blockchain technology across industries, making them more stable and less affected by short-term fluctuations in cryptocurrency prices.

Conclusion

Both Blockchain and Bitcoin ETFs offer unique benefits and risks. Blockchain ETFs provide diversified exposure to the broader technology, appealing to investors seeking stability and innovation. Bitcoin ETFs, by contrast, offer a more direct route to profit from Bitcoin’s price movements, ideal for investors with a higher risk tolerance. Understanding these distinctions can help investors choose the right ETF for their portfolios.