Bitcoin recently achieved its highest-ever three-day closing value at $72,724 on October 29, surging 8.75% within a single day. This rally saw BTC surpass a key resistance level of $71,500, prompting investor speculation of potential returns on investment (ROI) between 145% and 530% over the coming 12 months, as suggested by certain market indicators.

Bitcoin may reach a high between $175,000 and $450,000

As Bitcoin approaches the end of a seven-month price consolidation phase, many expect new all-time highs (ATHs), signaling the start of a price discovery period.

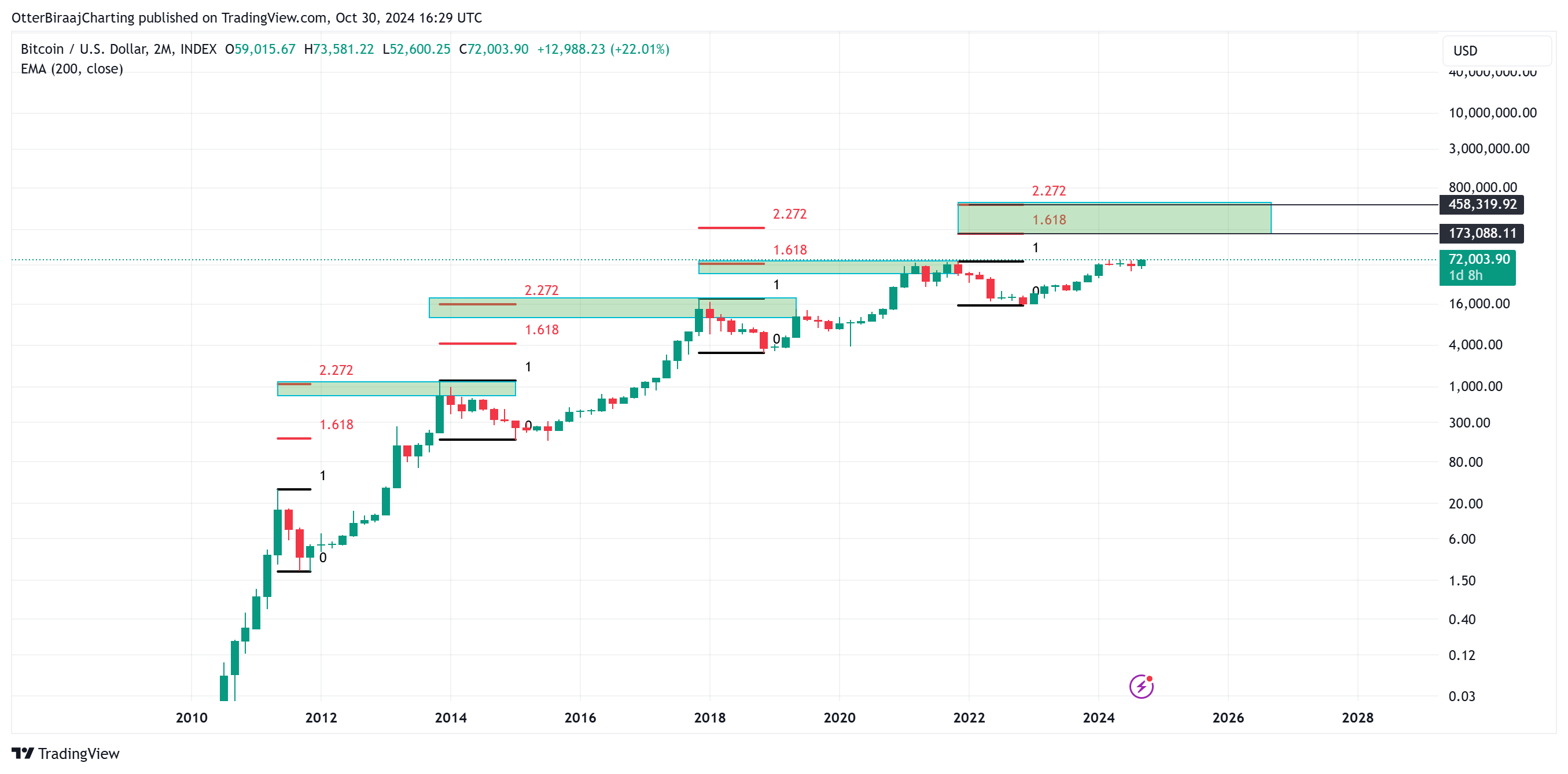

Recent data and studies have led to various predictions, with Bitcoin historically reaching peaks within Fibonacci retracement levels of 1.618 to 2.272. Each high point in BTC’s history has been found within this range.

As shown in the chart, each peak since 2013 has occurred between 1.618 and 2.272 Fibonacci levels. The current projections suggest Bitcoin’s price target is set at $173,088 for 1.618 and $458,319 for 2.272.

Historically, however, Bitcoin’s price has often topped slightly below these Fib levels. For instance, in 2013, BTC peaked just above the 2.272 level, while in 2018, it fell just under it. In 2021, BTC reached a cycle high of $69,800, which was below the 1.618 level.

Following this trend of “diminished returns over each four-year cycle,” the next peak in 2025 or 2026 might stay below $173,000.

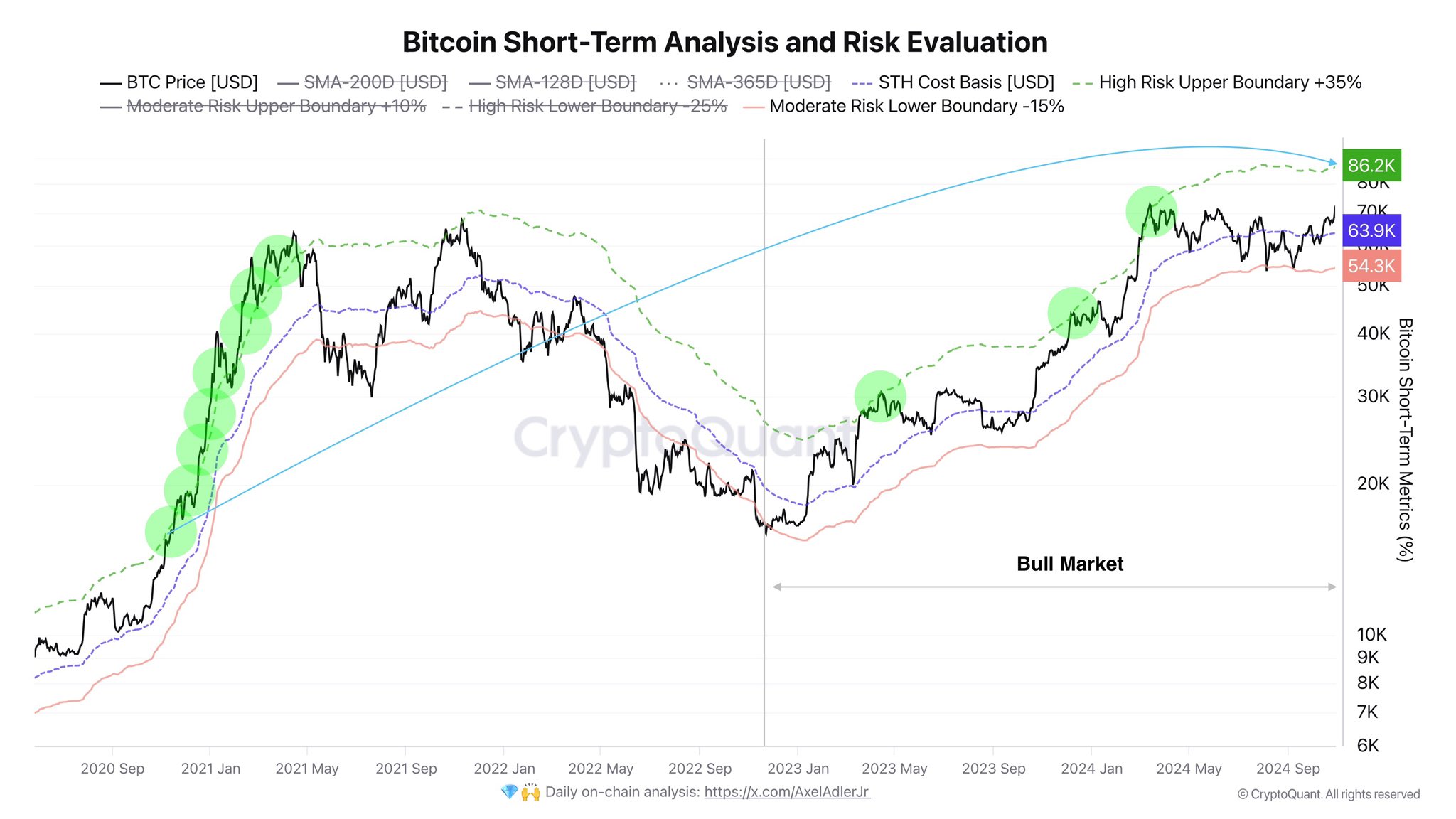

Bulls Face Critical Test at $86,200

Bitcoin analyst Axel Adler Jr. has noted that $86,200 is a key level that will decide the fate of BTC bulls.

Referencing short-term holder data and a risk analysis chart, Adler Jr. stated that BTC would hit a high-risk boundary around $86,200 for the current cycle.

Historically, this level has marked a crucial point for profit-taking by short-term holders, as seen from January 2023 to January 2024, when BTC’s price temporarily peaked.

A breakout above this point led to Bitcoin’s 2021 exponential rally, initiating a new price discovery phase. Adler concluded:

“If the price breaks above this point and forms a strong bullish momentum, we’ll finally see what everyone has been waiting for.”