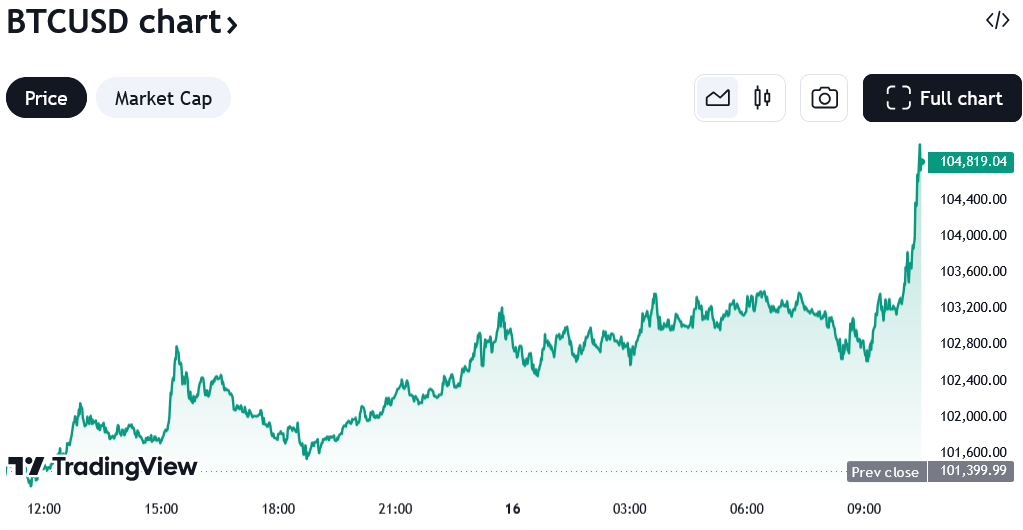

Bitcoin’s value experienced a sharp 5% surge within a single day, reaching an unprecedented peak of over $106,000 on December 15. This milestone comes amid growing speculation that Bitcoin could eventually be recognized as a reserve asset in the United States.

According to TradingView data, Bitcoin reached a high of $106,554 before dipping slightly to stabilize at $106,000. Its previous record of $104,000 had been set earlier on December 5.

CK Zheng, the Chief Investment Officer at ZK Square, described the current market behavior as Bitcoin entering a “Santa Claus mode.” He explained that many investors, driven by the fear of missing out (FOMO), are increasing their investments in the cryptocurrency.

Zheng forecasts Bitcoin could reach $125,000 by early 2025, but he also cautions about the likelihood of a 30% price correction afterward, as much of the optimistic sentiment surrounding the incoming Trump administration may already be factored into its current valuation. A 30% dip from $125,000 could see Bitcoin retrace to approximately $87,500.

This bullish momentum aligns with remarks from Jack Mallers, CEO of Strike, who suggested that President-Elect Donald Trump might issue an executive order to classify Bitcoin as a reserve asset upon taking office on January 20.

“There’s potential for a day-one executive order to purchase Bitcoin,” Mallers stated, emphasizing that while it wouldn’t involve acquiring 1 million coins, it would still represent a significant investment.

On the state level, Satoshi Action Fund CEO Dennis Porter disclosed that a third Bitcoin reserve bill is being drafted, though he refrained from naming the state involved.

Following Pennsylvania and Texas, Porter anticipates at least 10 states to propose similar legislation, signaling broader adoption of Bitcoin as a reserve asset. “It’s not going to stop. We’ll see more and more of these bills coming,” he said during a December 15 X Spaces event.

Adding to this optimism, financial analysts predict a 0.25% interest rate cut by the U.S. Federal Reserve on December 18, which could further bolster Bitcoin’s price in the months ahead.

Another driving force is a new rule introduced by the Financial Accounting Standards Board. This regulation, effective for fiscal years starting after December 15, allows institutions to reflect the value of their cryptocurrency holdings more accurately in their financial statements.

Currently, market sentiment remains highly positive, with the Crypto Fear and Greed Index showing an “Extreme Greed” score of 83 out of 100.