A rally in Chinese stocks that started in September lost momentum on Tuesday as markets reopened after a weeklong holiday. Bitcoin (BTC) experienced a decline during early Asian trading hours, with broader market reactions causing further dips.

Bitcoin briefly dropped to $62,000 late Monday during U.S. trading hours, before recovering to $62,700 in Asian markets. This erased nearly all gains made over the past week. Other major cryptocurrencies like Solana (SOL), Ethereum (ETH), XRP, and Binance Coin (BNB) followed suit, losing up to 4% and reversing Monday’s gains.

The CoinDesk 20 (CD20) index, which tracks the largest cryptocurrencies by market capitalization, reported a 2.18% loss.

Investors were widely anticipating fresh stimulus measures from China’s National Development and Reform Commission (NDRC) in a Tuesday briefing, following the Golden Week holiday. Earlier in September, the Chinese government announced rate cuts and liquidity support to revitalize its slowing economy, sparking expectations for additional steps.

Hopes for a major rally across Chinese and global markets—including cryptocurrencies—were high as traders returned from the holiday break. However, the briefing failed to deliver significant new stimulus measures. The lack of urgency, coupled with vague details, disappointed investors. Additionally, ongoing concerns about geopolitical tensions in the Middle East weighed on market sentiment. This led to profit-taking after recent rallies in both stock and crypto markets.

China’s stock markets reflected the mixed investor reaction. The Shanghai Composite index surged by 4% after opening but later declined as the day progressed. In Hong Kong, the tech-heavy Hang Seng index reversed its earlier gains, falling nearly 7%.

Some analysts had warned that the late September rally might not have the strength to maintain its momentum, especially as China’s latest stimulus package appeared less aggressive than previous cycles, such as the 2015 effort that had a longer-lasting impact on asset prices.

NDRC Chairman Zheng Shanjie described China’s economy as “stable” and “progressing,” affirming the government’s confidence in achieving its growth target of around 5% for the year, as reported by Bloomberg.

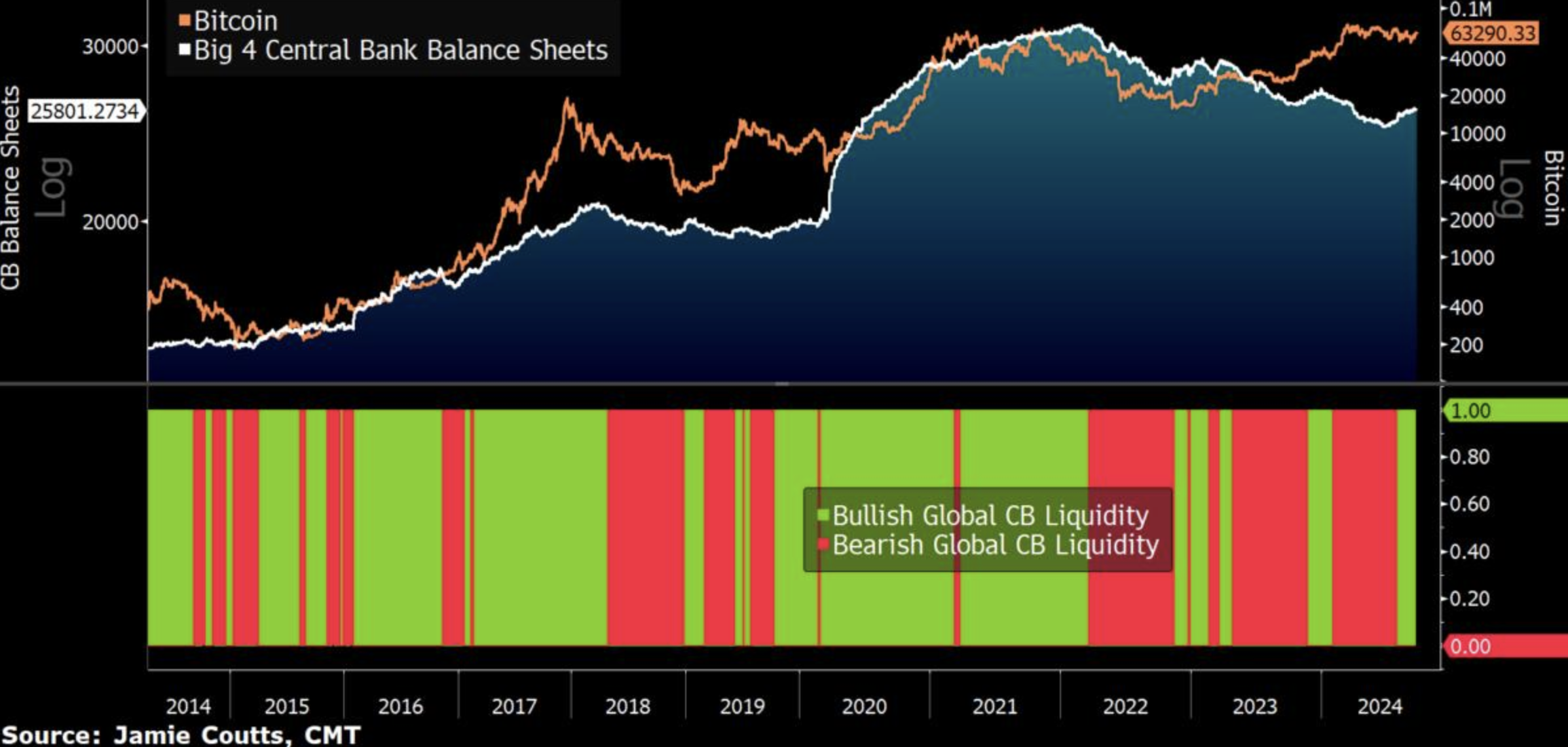

Meanwhile, crypto traders are now turning their attention to key U.S. economic events. The Federal Reserve is expected to release the minutes of its most recent Federal Open Market Committee (FOMC) meeting later this week, along with key economic data from August. These reports will provide further clues on the central bank’s stance and future positioning for monetary policy, which could influence the broader financial and cryptocurrency markets.