Singapore Gulf Bank, a digital bank known for its crypto-friendly approach, is reportedly seeking to secure at least $50 million in funding as part of its strategy to acquire a stablecoin payments firm in 2025.

A Bloomberg report from Nov. 25 suggests that the bank plans to sell a 10% equity stake by early 2025 to raise the required funds, citing individuals familiar with the matter.

The bank, managed by Singapore’s Whampoa Group—a family office recently licensed to operate in Bahrain—has not yet commented on the report when approached by DexStory.

Insiders claim that Singapore Gulf Bank is in discussions with a sovereign wealth fund from the Middle East and other potential investors to facilitate the equity sale. The raised capital would be allocated towards enhancing its payment infrastructure, boosting product development, and attracting top talent.

As part of its expansion plan, the bank reportedly intends to purchase a stablecoin payments company located in the Middle East or Europe by the first quarter of 2025.

The Middle East has been a hotspot for Web3 innovation, with investors from Bahrain, Dubai, and Abu Dhabi driving much of the region’s growth.

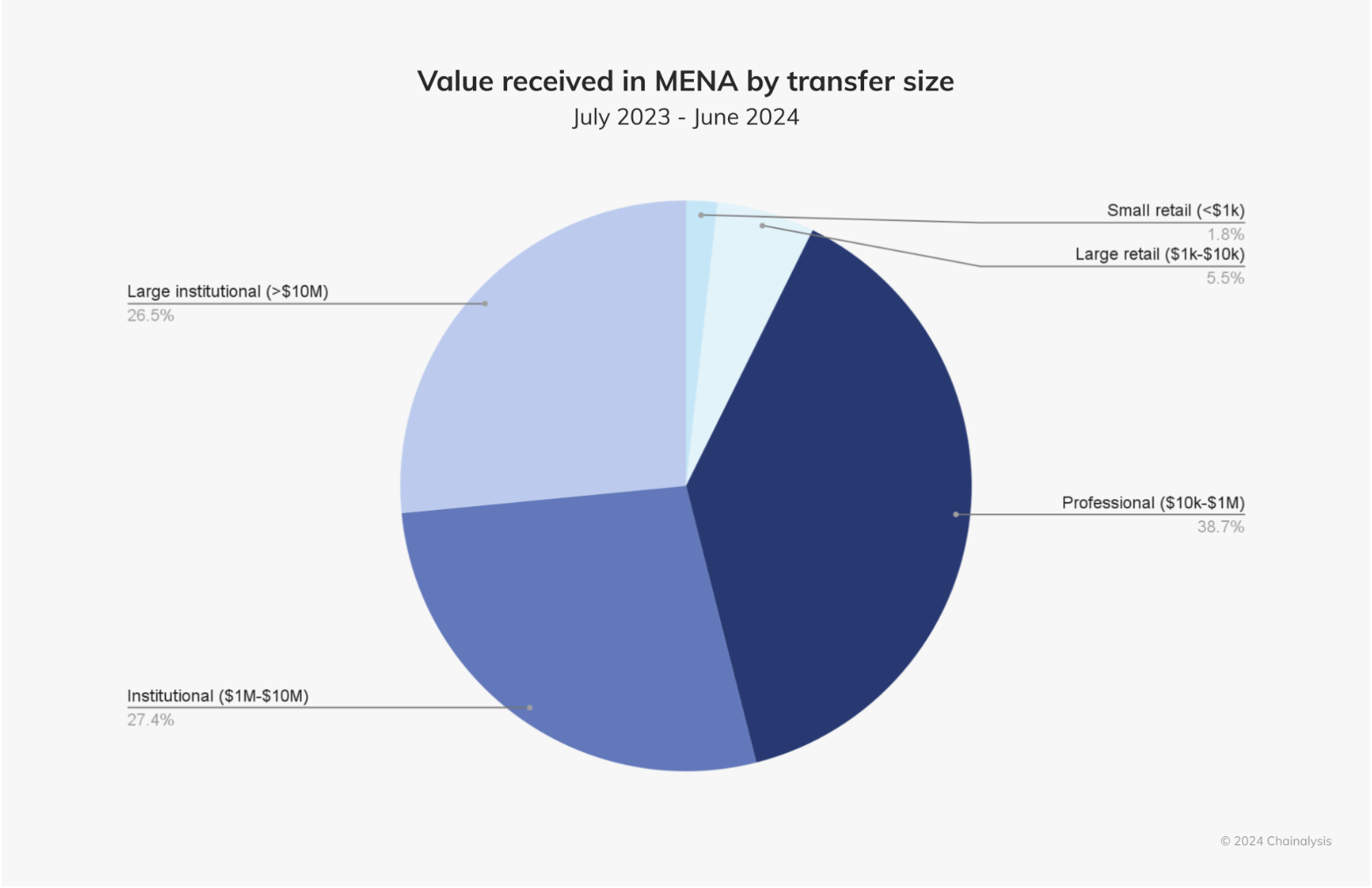

According to a September report from Chainalysis, the Middle East and North Africa (MENA) region contributes 7.5% of the global cryptocurrency transaction volume.

The study also highlighted that a vast majority—93%—of these transactions were high-value, surpassing $10,000, while smaller retail activity represented just 1.8% of the region’s total.

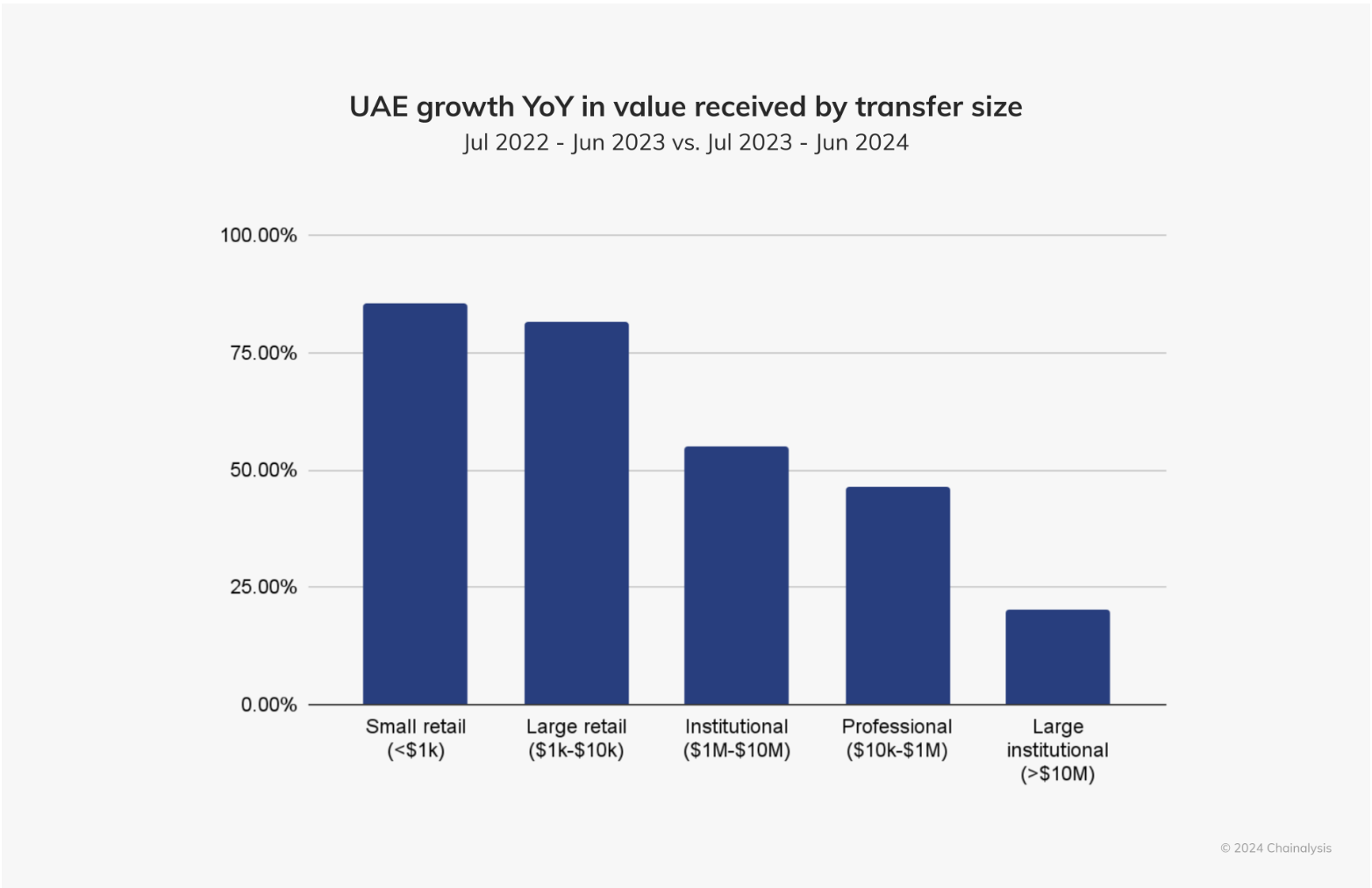

The majority of crypto transactions in MENA are conducted through centralized exchanges. However, there is growing interest in decentralized platforms, particularly in nations like Saudi Arabia and the UAE.

In a related development, the Central Bank of the UAE recently approved a custodial insurance product designed to safeguard financial institutions and clients against risks such as hacking, internal fraud, and infrastructure failures.